It's cheaper to save the world than destroy it: author Akshat Rathi on Climate Capitalism

Transcripción del podcast

This transcript has been generated using speech recognition software and may contain errors. Please check its accuracy against the audio.

Akshat Rathi, author 'Climate Capitalism': This idea that, yes, we are doomed because we are just not doing anything about climate change is completely untrue.

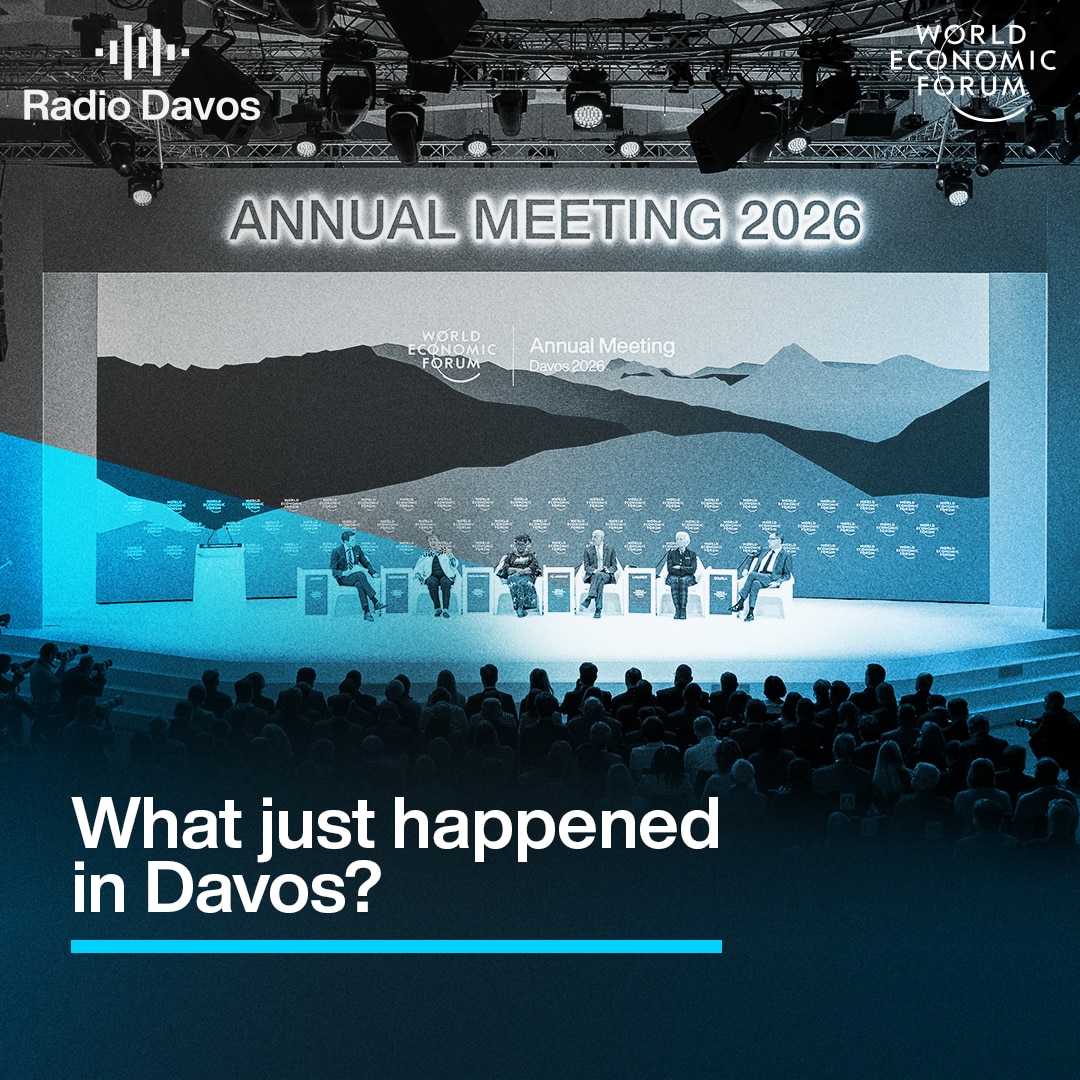

Robin Pomeroy, host, Radio Davos: Welcome to Radio Davos, the podcast from the World Economic Forum that looks at the biggest challenges and how we might solve them. This week: Climate Capitalism - we speak to the author of a book who says it is possible for humanity to stop the worst of climate change, even within the imperfect economical structures we all live in.

Akshat Rathi: There are different capitalistic systems, different in China from India, from the US, in Europe, but they are all under capitalism, except climate is modifying how capitalism has to work.

Robin Pomeroy: Akshat Rathi is Bloomberg’s senior climate reporter, that's a job that has taken him to boardrooms around the world to work out how companies can make the huge changes needed to tackle climate change.

Akshat Rathi: They have to figure out the reason for doing this is not just greenhouse gas emissions, but global competitiveness. Climate solutions don't have to be just because of greenhouse gas emissions. They need to fit in the economic system that we have in the world.

Robin Pomeroy: Akshat Rathi looks at economic and political factors that have already changed the game from China and India to Europe and the US - and his conclusion is one, perhaps surprisingly, of optimism.

Akshat Rathi: People have learned how to make progress happen despite the resistance to change.

Robin Pomeroy: Subscribe to Radio Davos wherever you get your podcasts, or visit wef.ch/podcasts where you will also find our sister programmes, Meet the Leader and Agenda Dialogues.

I’m Robin Pomeroy at the World Economic Forum, and with Akshat Rathi, author of Climate Capitalism…

Akshat Rathi: Climate Capitalism, it's cheaper to save the world than destroy it.

Robin Pomeroy: This is Radio Davos

“Climate Capitalism is an antidote to the dominant narrative that because we’ve ignored the climate crisis for so long, it will soon be too late. While it’s true that we’ve not done enough yet, we’re nowhere close to being too late.”

So says Akshat Rathi, Bloomberg’s senior climate reporter, and host of the podcast Zero, in his new book Climate Capitalism, which looks at ways business and industry and finance can make, and in some cases is making, real progress on climate change.

One of the quotes on the cover calls the book is: “A much needed does of optimism - based on data, not blind hope.”

I caught up with Akshat at the World Economic Forum’s Annual Meeting in Davos and started by asking him why he wrote the book.

Akshat Rathi: The book started off as trying to figure out whether people are doing enough around the world to try and tackle climate change. And I thought I'd find examples here and there in small scale. But, you know, we know the challenge is so big and we're nowhere on track.

What happened instead was I found solutions all around the world working at scale. And so this idea that, yes, we are doomed because we are just not doing anything about climate change is completely untrue.

And it became Climate Capitalism because all of these solutions are playing out under capitalistic systems. You know, there are different capitalistic systems, different in China from India, from the US and Europe, but they are all under capitalism except climate is modifying how capitalism has to work for these solutions to scale.

Robin Pomeroy: I'm going to read the first line of the book, which is a great first line. Jane Austen would have been proud. 'It's now cheaper to save the world than destroy it.'

Why did you make that your first line?

Akshat Rathi: I think, stating it plainly, that economic analysis now for years has been clear that if you don't do enough to tackle climate change, you will cause more damage to the planet that you will have to pay more to deal with later. It's just that it still hasn't quite sunk in to the larger audience. And I felt like starting, which might seem like a provocation, but is backed by years of research, might be a really good, solid place to start the book.

Robin Pomeroy: The problem you have with climate change is, the tragedy of the commons, though, isn't it? So I could be carbon neutral or negative. So could any one particular company or a country, but if it's not done at scale... So I could still make a lot of money out of being very carbon emitting as many companies are. So I think that's that's the problem you're grappling with here. And I suppose if you're looking at capitalism, it's like these companies which are driven by profit, can make profit as they address the climate crisis.

Can you give us some examples? You go through chapter by chapter in different sectors. What are the ones that have really impressed you, you thought, wow, I didn't see that coming.

Akshat Rathi: Capitalism is driven by a profit motive. But the profit motive has always been, to some extent, sometimes light, sometimes heavy, regulation. That's where I feel trying to figure out how climate change and the climate challenge is modifying capitalism is so key.

And so through the book, I go through technology solutions, but also systemic levers that are being changed to tackle the problem.

I start with China because for all the flaws that is China, the world's largest greenhouse gas emitter, the world's largest consumer of coal, it is also the world's largest deployer of all clean energy- solar, wind - also the largest maker of electric car batteries and the largest manufacturer of electric cars.

The energy transition, for all the blame that India and China get, is also starting to happen in those very places. But those are places which have to take a different tack to try and tackle the climate challenge. They have to figure out the reason for doing this is not just greenhouse gas emissions, but global competitiveness.

China built the industry to make solar panels because there was a demand in Europe for those solar panels. Later it started deploying it back home.

So climate solutions don't have to be just because of greenhouse gas emissions. They need to fit in the economic system that we have in the world.

Robin Pomeroy: We've known for decades that we need to reduce or abolish greenhouse gas emissions, but they keep, they're still going up. And I wonder what could have been done and now what should be done now. People talked in the past about carbon taxes or energy taxes. It's still being talked about. You talk about China producing all those emissions, a lot of those emissions are for stuff we're buying in Europe or America. We've exported a lot of those emissions to those countries.

Again, tragedy of the commons, no point us taxing our own manufacturers if we're not taxing those products. Is something like that, putting a price on the emission of carbon, is this thing we've never been able to do. And there's obviously a lot of resistance to it for many understandable reasons. Where do you see that going?

Akshat Rathi: Let's take a step back and recognise that, yes, we are hitting new record greenhouse gas emissions. We did so in 2023, the hottest year on record.

But we also must recognise that it could have been way worse had the Paris Agreement not been signed, did we not have COP26 in Glasgow in the UK in 2021 or COP28, in Dubai last year. Those are places where governments have put clear commitments. And because of the mechanism in which global diplomacy works through peer pressure, these governments have been forced to set, now the world's largest economies have these net zero targets, and they are starting to put legislation in place, like the European Green Deal or the Inflation Reduction Act, to try and act on the problem.

So yes, we are not on track, but it could have been way worse had we not started to act.

In terms of global solutions. Of course, it's a global problem, you want a global solution. But just because a global carbon price doesn't seem to be the politically feasible outcome, even though it might be the economically most optimal way to try and address emissions, does not mean we can't find ways to reduce emissions.

And that's why the climate capitalism framework is what works in your political context.

The US Inflation Reduction Act is an implicit carbon price, because what it's doing is it's subsidising clean energy. That means it's making fossil fuel energy relatively more expensive.

Europe has a carbon price and it's working. It's €60-80 a tonne, which is quite significant. And it's only going to increase.

China and India are both now - China has already established a carbon price, it is quite low right now, but it'll grow. And India is considering putting one.

So you start to see these places where because Europe came up with a carbon price and now wants to use what is known as a Carbon Border Adjustment Mechanism, where they will charge you the person exporting or Europe importing your carbon intensive good a carbon price that European industry is paying. Suddenly India and China who might get those taxes are starting to put those prices in their own regions.

So it's a messy place to be. But there are clearly solutions that are starting to work.

Robin Pomeroy: Do you think that will work, the European border tax?

Akshat Rathi: Well, we are seeing that already because Europe is committed to it, and despite lots of protestations from India and China, has not backed out. India and China kind of don't have a choice. And so they're starting to think about, okay, well, this is something if we are going to have to deal with this reality, still trade with Europe, then we'll have to find a way to do it.

And so, will it work? It's going to be messy because it's politics. But clearly there's a way in which it could work, and Europe seems committed, and that's a good sign.

Robin Pomeroy: Now, you and I have been reporting on climate change for a long time. I might even beat you in terms of longevity, COP6 being my first COP. And at that point there was still a lot of climate denial, a lot of lobbying to prevent any kind of global move towards addressing the issue. And one thing that was happening when I was reporting back then was changes in the administration in Washington. And we're looking at the possibility of that again now.

Now, putting aside any political preferences, it's quite clear that you've got two parties here that have very, very different approach. And that's exactly what happened with the Kyoto Protocol. A Democratic administration was agreeing that and was going to try and get it through Congress. A Republican administration just walked away from it from one day to the next.

Could a similar thing happen from November, if the Republicans win the election? Where do you see that going?

Akshat Rathi: It's a very real risk. Donald Trump is likely to be the Republican candidate. And where polls stand right now, it's a toss up. And so that is a real risk.

The US has always been, as you know, the historic largest greenhouse gas emitter and the second largest greenhouse gas emitter even today. And also, of course, the largest economy. A really key part of whether climate as a problem could be solved or not.

I actually had Tom Steyer, a former presidential candidate who, came on Zero, my podcast, and we talked about this very issue.

From his perspective, and I kind of agree with it, is that the way the Inflation Reduction Act has been created is unlikely to get rolled back very much. Much of the money that is going through these subsidies is actually going to red states. It's creating jobs in places where jobs are needed. It's going to places where there is a lot of land and renewables can be deployed.

Culture wars apart, political polarisation apart, the economics of having good paying jobs are something that all politicians on both sides of the divide agree.

The biggest risk that Steyer saw, and I feel like is the risk that is one that we should watch out for, is what happens to global climate ambitions.

Because, just like Donald Trump did last time, he might want the US to walk out of the Paris Agreement. And that kind of flip-flop is never good for investors, for people who want to make sure that their money gets invested in a place where they can secure a stable rate of return, because otherwise you're not going to be able to scale these climate solutions.

Robin Pomeroy: I wonder what you're hearing from business leaders here in Davos and in your reporting around the world. Because I remember all those years ago, decades ago, speaking to leaders of fossil fuel companies who were desperately wanting clarity on climate change. Okay, maybe they didn't want to go as far and as fast and there were things they were lobbying against. But some of those companies - I'm talking very, very big oil and gas firms - were saying 'we need a global consensus on this. We need clarity'. What they don't want is a flip-flop. What what are you hearing now from those kind of people?

Akshat Rathi: So, two ways to think about this challenge. Here at Davos it's a conversation around many things, climate being one key part of it. You know, about a quarter of the panels on the main stage are climate related. But climate gets mentioned on many other panels. But it's not the only risk. The Global Risks Report that came out put misinformation and disinformation very high up, social polarising.

Robin Pomeroy: In the short term.

Akshat Rathi: Yes, in the short term.

Robin Pomeroy: Climate change remains the top, not just one, but the top four, in the long term.

Akshat Rathi: But many of the problems in the short term are things that we don't really have a solution for.

Misinformation and disinformation is likely to get worse before it gets better. And how it gets better, we don't know. Social polarisation is the same problem. You know how to rebuild trust in institutions, or government or even companies is not one that we have found solutions for.

Climate, on the other hand, for all the difficulties that it poses, is actually one where there is a systematic plan, where, because of 30 years of work, where, as you said, fossil fuel interests slowed things down, slowed progress down, people have learned how to make progress happen despite the resistance to change. And that's required international institutions, government policy, experimentation, entrepreneurs, financiers who are willing to take risks to come up with new models to fund this.

And so climate kind of shows, if you take a systematic approach, yes, it can take time, when you do have the capacity, humans do have the capacity to tackle a big problem.

When I'm speaking to investors here, that's what shines through, which is, yes, we are in a period of perhaps a risk of a recession coming this year and a period of high interest rates. And investors have generally shirked away from the sort of risky investments. But in climate, big investors I've spoken to have said the interest in sustainability, ESG investments in climate solution continues to remain.

And so we have all this money that's coming in. Now we just want to make sure it goes to the places where there isn't flip-flop happening. And of course, US is the largest economy. But it doesn't, it's not the only place where investment needs to go. There are plenty of other places where flip flop isn't happening and the capital could be absorbed.

Robin Pomeroy: Well, you just mentioned ESG there, which is, of course everyone in Davos knows what it is, but normal people might not know: environmental, social, governance - a big part of this kind of stakeholder capitalism idea, which is very close to the heart of the World Economic Forum. However, in recent years, last couple of years, ESG has become a bit of a bogeyman of parts of of the Republican Party, for example, elsewhere in the world, you know, the right wing, all the populists. Some people are pulling money out. If you look at the state of Florida, because they just don't like this 'woke nonsense,' they want to get companies back to earning money and they shouldn't be dealing in this kind of stuff.

Is this a fringe activity, or do you think this is a real danger to moving the money into stuff that makes money, that gets the economy moving, but actually isn't going to destroy the planet.

Akshat Rathi: So ESG is something that we look at very closely here at Bloomberg Green, alongside my colleagues who cover this day in and day out. And even before the 'woke brigade' came along and the politicisation happened, ESG was in a messy place.

Conceptually, you would agree it's an idea that's worthy of pursuing: rather than just caring about the bottom line, there are other non-financial metrics that do matter to humans and to progress. Those are environmental, but also social. You know, making sure that women have the power in a workplace, making sure that you have distribution of opportunity across the world. These are things that are hard to put down on the bottom line of profits, but can make those profits actually grow.

We have looked at this from econometrics perspective in studies where if you take care of ESG metrics, they actually show up as a benefit to the company in its core mandate from the shareholders.

But it's also in a messy place because we don't know how to measure these non-financial metrics. And there's been a ton of greenwashing that has happened, especially on the environmental metric, when investors have thought, yes, it's a good ESG company because of course, their emissions seem to be low, and they put their money there and then find out actually they've been using some shitty offsets that do not really provide the service of reducing emissions as it's needed.

That was before the woke politicisation happened.

So ESG has to face up to the challenges, which is it needs to be sure that the numbers and the metrics that it's giving a sheen on, whether these decisions are actually based on real world outcomes.

The good news is, while there's politicisation happening in the world's largest economy, the world's second largest economy is actually laying down really clear rules, here in Europe, to make sure that the investors have clarity in investing on ESG.

And again, those rules are in a messy place. But at least the government is committed on figuring out what will work for the industry and for real world outcomes.

And so, again, in the climate space, what I've seen is it's usually if you take two steps forward, you end up taking one step backward. And that can be a challenge that we just have to face as we go down this decades-long challenge.

Robin Pomeroy: Davos 2024 - climate, a big issue. You mentioned you counted up a quarter of the sessions here, it's about climate change. But the flavour of the month this year is definitely artificial intelligence. You've got all those big names walking around here in Davos, everyone's been talking about AI.

Now where do you see AI fitting into the climate change thing, because the real flag wavers for artificial intelligence, and it makes me kind of laugh sometimes because it's someone who's been impressed by a poem written by ChatGPT that starts with a different letter of the alphabet. And then, because that's so impressive, they'll say AI is going to solve climate change. It's a bit of a bit of a jump there. What do you think?

Akshat Rathi: So it is funny, these hype cycles, you know, around technology, they come and they go. And, AI is perhaps not a new one. If anything, I was covering, climate companies a decade ago that actually were using some of the tools that we now call AI, they were called machine learning back then, which consumed a big data set, but made sense of it in a smart way by learning how the outcomes of certain experiments feed into real world outcomes. So they used machine learning to come up with a breakthrough battery material that's now going to end up in a Volkswagen car.

And so artificial intelligence or the ability to try and make sense of big data, has always been a very interesting tool for climate solutions.

What we are seeing now is that it's actually being deployed in other domains within climate.

So I've covered a company that uses AI to try and deal with how to make sure that the grid copes with all these electric cars coming online in many different parts of the world.

There is artificial intelligence solutions to try and make predictions on weather related impacts much more granular, much more closer to what could be information that somebody could act on.

These are these are benefits that are going to both speed up the process of deploying these solutions, but also work on a set of solutions that we've not paid much attention to, which is how do we adapt to the warming that's already happened.

So AI, yes it's a hype. And, you know, we'll go through the hype cycle and find out much of the hype is going to be around dud ideas, but there are a core set of ideas that will help and will make climate solutions a speedier option.

Robin Pomeroy: What are you looking out for in the year ahead in your domain. You're covering every day at Bloomberg News, climate change. What are the things you're hoping to or fearing will happen this year?

Akshat Rathi: So we're coming through the hottest year on record and likely going into another record hot year. That means there's going to be a ton of extreme weather events. And the nature of these weather events is that we don't know where they land. We just know they will land.

And so what does that do to economic growth, to political outcomes, to migration patterns? All of that could be said this year.

But then the two other places that I'm really looking is, one, around this big idea of reforming international financial institutions. World Bank and the International Monetary Fund, but also development banks around the world, are crucial levers that need to play a part in moving large capital from rich countries to poor countries for climate solutions.

Because, you know, as the book said, Climate Capitalism, it's cheaper to save the world than destroy it. But that cheap portion will only become reality if that capital moves to the places it needs to go.

And there are a set of meetings that are going to happen this year where we could see real change in how these institutions operate and whether they are able to put more money towards climate solutions.

And the third one, which is a pet project of mine, is to look at climate technologies, because yes, we have solar, wind, batteries, electric cars, but that's not the full solution set. We need hydrogen, we need lab grown meat. We need a ton of innovation on agriculture emissions that we don't think about very much.

And that will only happen if we get venture capital money going into ideas to help these start-ups, bring them to commercial scale. And last year, we saw a decline in venture capital funding for climate, which is a tough place to be for many of these start-ups, that may take 5 or 10 years to come to fruition with their ideas.

And so will that trend reverse this year? Will this money that investors say they have as dry powder sitting to be put in solutions go towards start-ups is something I'm watching for.

Robin Pomeroy: I mean, all that money will be going into AI, won't it? But presumably a lot of those innovations you're talking about will be incorporating AI. I've seen innovations in farming that are using real high tech solutions and some very smart machine learning. So maybe that will help unlock some of this funding.

Akshat Rathi: And then there will be some silly money going too. Many of the Start-Ups I know have changed the website that they have from whatever they are called dot com to something dot AI, and suddenly they're able to attract more money. So yes, you know venture capital has its problems that, you know, they try and throw money at lots of problems. And then maybe some of those stick into becoming big solutions. But it's a crucial part of the innovation and infrastructure that we've built.

Robin Pomeroy: We're almost up for time, Akshat, I'll just ask you, is there any book you would recommend to anyone? What are you going around recommending to people?

Akshat Rathi: I would recommend the book The Great Derangement. It's by Amitav Ghosh. He's actually a fiction writer. He writes novels, but has, for the past decade or more, been really taken aback by how little climate is discussed outside the domain of business and finance, and so little of it ends up in culture, in conversations that we have around the dinner table. And he's raised the alarm through this book, The Great Derangement, and then put his own findings of how we struggle with it into action by writing novels around climate issues, which are not about science fiction. It's climate that's playing in the background, shaping the lives of the characters, bringing to life these challenges in a way that we typically don't see. So that's a great read.

Robin Pomeroy: Well the book is called Climate Capitalism: Winning the Global Race to Zero Emissions. The author is actually Rathi. Thanks for joining us.

Akshat Rathi: Thanks for having me.

Robin Pomeroy: Akshat Rathi is senior climate reporter at Bloomberg.

Check out the work of the World Economic Forum’s Centre for Nature and Climate - there's lots of useful information on our website.

Please subscribe to Radio Davos wherever you get your podcasts and please leave us a rating or review. Find all our podcasts at wef.ch/podcasts.

And join the conversation on the World Economic Forum Podcast Club, that's on Facebook.

This episode of Radio Davos was written and presented by me, Robin Pomeroy. Studio production was by Taz Kelleher.

We will be back next week, but for now thanks to you for listening and goodbye.

Scroll down for full podcast transcript - click the ‘Show more’ arrow

“Climate Capitalism is an antidote to the dominant narrative that because we’ve ignored the climate crisis for so long, it will soon be too late. While it’s true that we’ve not done enough yet, we’re nowhere close to being too late.”

So says Akshat Rathi, Bloomberg’s senior climate reporter and host of the podcast Zero, in his new book Climate Capitalism, which looks at ways business and industry and finance can make, and in some cases are making, real progress on climate change.

Picture credit: Sofia Yang Martinez

Mentioned in this episode:

Links:

Related podcasts:

Check out all our podcasts on wef.ch/podcasts:

Más episodios:

La Agenda Semanal

Una actualización semanal de los temas más importantes de la agenda global

Más sobre Acción climáticaVer todo

Lee Beck

11 de febrero de 2026