IMF's Kristalina Georgieva: What's next for AI, skills and the global economy in 2026

Transcripción del podcast

Linda Lacina, Meet The Leader Welcome to Meet the Leader. I am Linda Lacina, and I am very excited to introduce you to Kristalina Georgieva. She is the Managing Director at the International Monetary Fund, and she is going to share some new research on the complex ways that AI is gonna be reshaping work, what that might mean for jobs and paychecks, and also what's needed to make sure that we're prepared. She's also gonna help us understand what's ahead for the global economy. How are you, Kristalina?

Kristalina Georgieva, IMF I'm very well, happy to be with you.

Linda Lacina, Meet The Leader Oh, pleased to have you. I wanted to get started here. Every year it starts with some measure of economic uncertainty. But what is different in 2026?

Kristalina Georgieva, IMF What we are seeing is that uncertainty has settled as the new normal. My message to everybody is learn to think of the unthinkable and then stay calm, adapt when the un-thinkable happens. I don't think anymore that we will go back to a world of predictability. Why? Because the world now is truly, genuinely multipolar. Because technology is moving so rapidly, changes are happening so fast, because we have other factors, like climate change hitting countries. And demography has split the world into aging, shrinking populations, and growing youthful populations, very often seeking jobs, and the jobs are not there. Complex world. And I think 2026 will be another year in which we will have to learn how to live, operate and prosper in this world.

My message to everybody is learn to think of the unthinkable and then stay calm, adapt when the un-thinkable happens. I don't think anymore that we will go back to a world of predictability.

”Linda Lacina, Meet The Leader The IMF just released its economic outlook that was just yesterday. What might surprise people about some of the trends?

Kristalina Georgieva, IMF The biggest surprise, I believe, is that we have upgraded almost everybody. We have upgraded our projections to now 3.3% for this year, 3.2% for next year, and that brought us back to what we were projecting in October before the tariff tensions started. And the question is, why is this resilience of the world economy? What are the factors defining it? And we came up with four. One, private sector. Almost everywhere on this planet, the government moved out from where it doesn't belong, running companies, and the private sector stepped forward. It is more adaptable, more agile, and we see the benefits of it. Two, trade tensions did not materialize on the scale people feared. In fact, the impact of trade on growth is muted, and we are encouraging people, especially now when there is some reappearance of trade tensions. Please keep it this way. We see AI as a very powerful driver of growth and potentially prosperity. And four, and something that we don't talk much about, our governments actually are doing a pretty decent job in deploying policies to support businesses and support households. So, we have a story. What is surprising in this story is the incredible resilience of the world economy. And I think we need to not only understand why it is resilient, but nurture this resilience for the future. Because going back to your first question, we are in a world of uncertainty. Do everything you can to have better buffers, better position in this world.

Linda Lacina, Meet The Leader You talked a little bit about the trade tariffs and sort of a muted impact that they had. Why is that? Why is it that trade tariffs didn't dent forecasts like we thought they would? Why is it?

Kristalina Georgieva, IMF Two reasons, one, the announced tariffs did not materialize at the level they were announced. In fact, what we have seen are deals, exceptions, corrections in the tariff path. And two, very important, we did not see tit-for-tat. Majority of countries have said we want to trade. It is good for us, especially medium-sized, small economies. And therefore, we choose to have the rules of trade apply. So, these two factors, more muted impact from US, and no tit for tat, no accepting restrictions to trade, they are the reasons. Now, let me be very clear. We should not take resilience for granted. we have to work to sustain good conditions. And ultimately, it is for the well-being of people. And how do you?

We should not take resilience for granted. we have to work to sustain good conditions. And ultimately, it is for the well-being of people.

”Linda Lacina, Meet The Leader See geopolitical instability affecting the economy in the year ahead? What are you thinking about when it comes to that?

Kristalina Georgieva, IMF Very clearly, geopolitical factors are now very significant for the world, and they play a role both disruptive and positive.

We often talk about geopolitical clashes. We forget to recognize that there are geopolitical positive developments, especially in the trading more with each other within the region and building more bridges with other parts of the world.

The fact that the world is now moving to multipolarity also means that there is positive energy coming from parts of world that are becoming more dynamic, economically stronger, and that are modeling cooperation. And that, I think, deserves more attention than it is receiving today.

Linda Lacina, Meet The Leader When you look at 2026, what are you thinking about when it comes to risks? And what are you thinking about when you're thinking about bright spots?

Kristalina Georgieva, IMF So in terms of risks, there are three that are very clear.

One is geopolitical disruptions that can lead to accidents in terms the functioning of the world economy.

Two, the artificial intelligence enthusiasm leading to increase in financing, but not... to increasing profitability and therefore possibly pushing investors away and we know that investors often act like a group. One moves; the others follow.

And three, I dare say, the thing we cannot see but it's likely to happen. Remember COVID, we didn't see it, it happened. Natural disasters affecting countries and regions, we don't know it, we see it, but it may happen. To us, trade disruptions remain a risk. We believe that so far, rational decision-making has led to trade retaining its role as an engine of growth. I personally believe that, never mind how we act, taken in the long term, trade will continue to be an engine of growth. We have traded with each other forever. And the way I think of trade is like water you put an obstacle it goes around it. But please let's not put too many obstacles. Let the water flow.

We have traded with each other forever. And the way I think of trade is like water you put an obstacle it goes around it. But please let's not put too many obstacles. Let the water flow.

”Linda Lacina, Meet The Leader As leaders are looking ahead to this year, in your mind, what would you think that they should be prioritizing? What should they keep top of mind?

Kristalina Georgieva, IMF Well, overwhelmingly, globally, one thing that has been lagging is the desire to have a peaceful world everywhere. Right now, we have some very visible wars, like the one in Ukraine, like the conflict in Sudan, in in in just far too in in the eastern part of DRC, the Democratic Republic of Congo, far too many places there is this flare of conflict. And I don't think that we are putting enough attention to mobilize the world from politicians to private sector to people to recognize that war, war is a horrible, horrible thing. I was just in Ukraine, in Kiev, dark, cold, people in fear, what may happen to them, to their families. And I cannot stress enough, if you think of humanity, this is the number one problem we have to aspire to solve.

Two, I see the risk of fragmentation. Deepening and a fragmented world is of course weaker, economically weaker, socially weaker.

Three, how we are going to take advantage of the miracle of artificial intelligence. Is it going to help majority if not all to have better opportunities, better jobs, better lives or it would be a divisive force in which the accordion of inequality opens widely.

And I think if you step back, what do people want? They want peace and well-being for them, for their families. When we simplify our objective to how can we have that for everybody around the world? I think we get our jobs quite clearly defined. For me, for my job, this means do all we can to help our 191 members make good policy choices for their people.

Linda Lacina, Meet The Leader You talked a little bit about trade and growth, but in general, rapid growth -- how should we be thinking about this? Is rapid growth still realistic, or do you think that maybe we are entering into maybe something fundamentally different, a new era?

Kristalina Georgieva, IMF Well, I actually do believe that there is potential for higher growth. Let me explain. This year, we are projecting 3.3% global growth. Historically, before the pandemic, the average was 3.8%. So, we fall short of this historic average year after year after, year after a year. And the question is, can that be corrected? Yes. If we are to just take the power of artificial intelligence, if it is deployed in a meaningful, well-calibrated, thoughtful manner, it can lift up growth by 0.8%, almost a percentage point accelerated growth. When we think about the potential of private sector, to deliver more dynamism. It is not entirely tapped. We still see a lot of self-inflicted injuries, red tape, that prevents private sector, prevents entrepreneurs for doing the best they can. So yes, we can aspire for higher growth. Let me just take one part of the world, Europe. The European Union over the last decades has been falling behind in productivity growth. And actually, I need to stress that the main reason growth has slowed down is because productivity growth has slowed down. So when you look at Europe, why is this happening? Well, because the Europeans went halfway to create the single market and competitive Europe. They actually know it. Mario Draghi wrote a report that says, these are the things we need to do, have a capital market union, integrate our energy system, allow free movement of skills, not just of people. If Europe does that, the potential for Europe to grow much faster is quite significant. I also see one problem that is solvable problem, government debt. One of the reasons resources have shrunk for public spending is because governments understandably borrowed a lot during COVID. And then they continue to borrow after COVID. Once you provide subsidies to people, it is very difficult to pull them back. Now, this government debt is in an era when interest rates are no more. Clause two or zero sucks away resources. Shrinking government debt is possible, but it requires political will and it requires bringing the public on board. Not an easy task, but not impossible.

Linda Lacina, Meet The Leader When it comes to new sources of growth, what is something that maybe you're keeping an eye on that maybe could be very interesting? And also, are people maybe overestimating what could be possible generally?

Kristalina Georgieva, IMF Well, I mean, obviously, I talked about technology and specifically about AI as a lift for productivity. But there are other aspects. For example, we have not been talking enough about the potential to go into energy efficiency, renewable energy, create green sources of growth. We are also not talking enough about the unknown, what are the areas, what are the products, the services, the activities that we don't know exist but are going to come, and how we make this an engine, an exciting engine of growth. It wasn't that long ago that we didn't have internet. Not long ago, the iPhone didn't exist. These are the things that are going to come. How we make them accessible for more people and how we create that energy of the new driving growth is going to be actually quite exciting.

Linda Lacina, Meet The Leader What are maybe the big macro conditions that are separating economies that are still growing versus those that might be sort of slowing and falling behind?

Kristalina Georgieva, IMF Well, when you look at the reasons for slowdown in growth, there are two that are universal. One is demography. When you have an aging society, it holds growth back. Whether it's Japan, or it is Europe, or now China, demography is an important factor. Another factor is availability of capital, especially Capital Four. Innovation. We have youthful populations, but capital doesn't go there. So how to create conditions to build the bridge from where the capital is, mostly in the north, to where the people are, the young people are mostly in south. That is actually part of what we do at The Fund to help these countries become more attractive for investment.

Linda Lacina, Meet The Leader The International Monetary Fund, you guys just released a brand-new study. It's on AI and new skills. And it digs into all of the very complex ways that AI, of course, is gonna reshape work. What are these new skills? And what is very important to understand about this complexity?

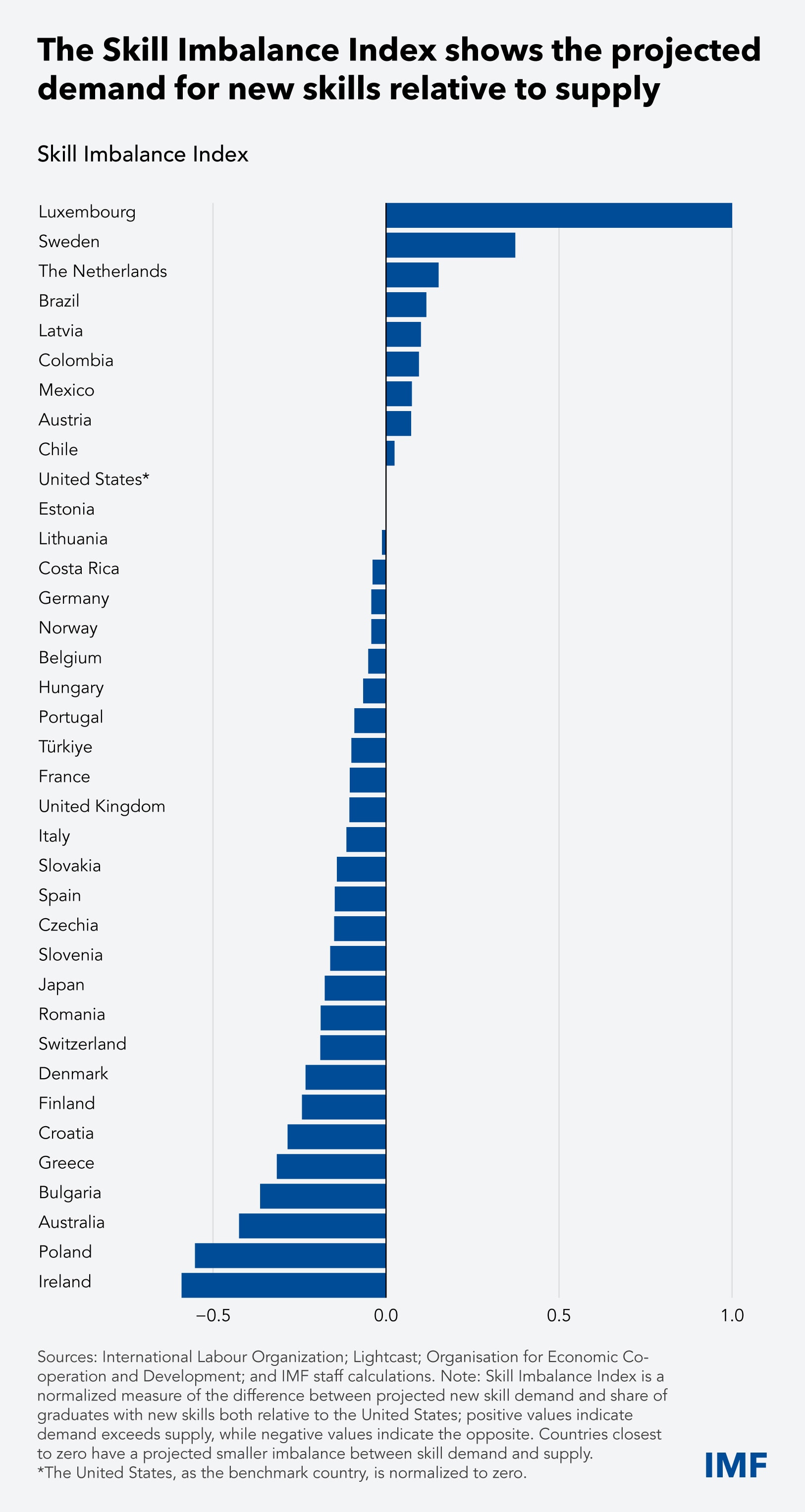

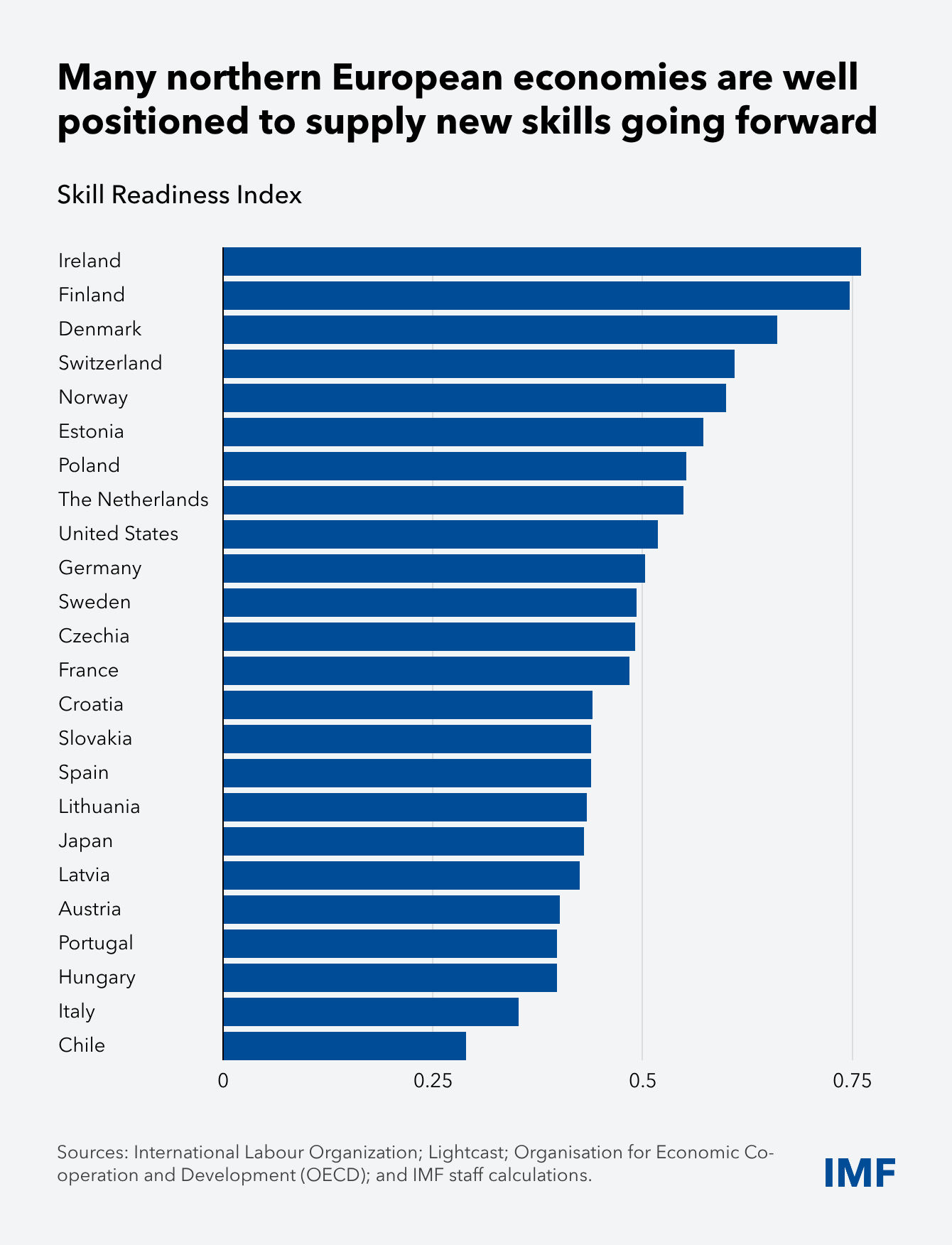

Kristalina Georgieva, IMF So what we are looking into is AI impact. Is it real? The answer is simple, yes. We now see that in advanced economies, one in 10 jobs require at least one new skill, sometimes two and three and four. What are these skills? They are half of what we see as new skills are IT related. But there are other aspects of new skills that are around management. They are around specific professional qualifications. Are countries able to produce these new skills? It's very interesting. We have done an assessment, and it shows that some countries have more demand for new skills than supply, and other countries have a more supply of new skills than demand. Clearly, they both have problems. Those that have more supply of new skills than demand, they have to create conditions for innovation for companies to grow fast. By the way, one thing that we see also is that younger, innovative, well-financed companies tend to be bigger producers of these new jobs requiring new skills. Where there is a problem of supply of skills, obviously. Create conditions to train people so they have the skills where you have to create more financing for opportunities for new skills than concentrate on removing obstacles. The short and the long of our story is that policymakers and businesses have choices. They can act when they are well informed. And what we are doing at the Fund is to provide this information. To them.

Linda Lacina, Meet The Leader They have a very make-or-break role even in sort of helping to guide people and create the environment for how this will unfold for different countries and different economies. How so? Can you explain why policy decisions might be so important and what are the strategic moves that they might need to be considering?

Kristalina Georgieva, IMF The criticality of policy decisions cannot be overstated. Fortunately, as I recognized, we have seen over the last decades, policymakers becoming more sophisticated, more knowledgeable, and very important, learning from each other. We as an institution, we are a place where people come to share experience, and as a result, policymaking across the world improves. So where do we want concentration? First, understanding. Policies can lift up skills in a country. Not only focusing on education, but also creating incentives for businesses themselves to invest in skills.

Two, we see very important role in removing infrastructure obstacles. For example, in many developing countries and in some advanced economies, there is still lack of the technological underpinning of connectivity. No access to electricity means a big obstacle for AI to come and prosper.

And three, we see huge role for policymakers to create an enabling environment for innovation-based companies to grow. And that is not as simple as it sounds. Does the government put money into venture funds or creates tax advantages if we invest in research and development? What is the right policy choice? And this is where institutions like the Fund have a role because we can assess objectively and then provide advice for a way forward.

Most importantly, pay attention on the distributional impact of your decisions. Are you making decisions that are going to benefit a small part of society at the disadvantage of the rest? How are you making sure that across your country, there is equal access to opportunities? And these are all very, very important questions. One of the areas where we specialize is actually tax policy. And we have learned a lot from experience in these different countries. What are the policies that benefit growth, employment, and prosperity?

Are you making decisions that are going to benefit a small part of society at the disadvantage of the rest? How are you making sure that across your country, there is equal access to opportunities?

”Linda Lacina, Meet The Leader You mentioned that one of the things your research has done is track the projected demand for skills in different areas. What does it say about the skills gap and how could that maybe increase other inequalities in maybe developing nations and things like that? What does say about this skills gap?

Kristalina Georgieva, IMF What we see is that the skills gap is more significant in emerging market economies, in developing economies. Which are the country's best positions? Northern Europe. You go to Finland, Sweden, Denmark, and you see a lot of historically well-taught true investment in skills, in education and skills. Flexibility is a very important factor. Don't assume that you know what the jobs of tomorrow are going to be. Teach not particular knowledge, but learning how to learn, how to adapt to a changing environment. And this is where the best advancements are taking place.

We also have to recognize that the United States, when it comes to innovation and technology have created really excellent enabling environment for companies to step forward, take risk, and that risk-taking is going to be even more important in the future. What we see is already that there is premium for new skills. It can go up to 15%.

Not only that when there are new skills and higher pay, that creates demand for more services and lower skilled workers find more opportunities for employment. It's very interesting. A 1% increase in new skills leads to 1.3% in overall employment. In other words, the fear that AI is going to not only reshape jobs but shrink employment so far is not proven by data. But there is reshaping of employment. Are there risks? Yes, especially for young people, because AI tends to eliminate entry-level functions. Entry-level jobs. So young people coming into the labor market are now understandably more scared about their future. Policymakers need to think how to buffer that.

Don't assume that you know what the jobs of tomorrow are going to be. Teach not particular knowledge, but learning how to learn, how to adapt to a changing environment. And this is where the best advancements are taking place.

”Linda Lacina, Meet The Leader And we have just one last question for you, Kristalina. Leaders are only as good as the questions that they are asking. As we are navigating all of these issues and all of this uncertainty, what is the number one question that maybe leaders, including leaders at Davos, should be asking themselves in 2026?

The fear that AI is going to not only reshape jobs but shrink employment so far is not proven by data. But there is reshaping of employment

”Kristalina Georgieva, IMF What is your response going to be when the unthinkable happens? I train my staff to think of the unthinkable. We run scenarios of things that are very low probability but high impact. And I think asking yourself how to operate in a condition of uncertainty, how to navigate when the fog is very thick I think, and also, how do you work with others? Because maybe somebody else has a flashlight that can help you go through the fog. Cultivating speed of response and that sense of 'together we are more resilient' is what I would strongly advocate for.

How do you work with others? Because maybe somebody else has a flashlight that can help you go through the fog.

”Linda Lacina, Meet The Leader Thank you very much. I very much appreciate your time, Kristalina. Thank you.

And thanks so much to you for listening. This is just the sampling of the insights we're sharing from this year to the end of the year.

And don’t miss the special daily episodes that my colleague Robin Pomeroy will release on his podcast Radio Davos. It’s the best way to get caught up on the buzz and the big news and how the top minds around the world are thinking about the biggest issues of our day.

That's it for now. I'm Linda Lacina from the World Economic Forum recording live from Davos. Have a great day.

What's ahead for the economy and how can leaders navigate economic uncertainty in 2026? Managing Director Kristalina Georgieva takes us through the the International Monetary Fund's new research on the surprising impacts AI could have on jobs and paychecks and which country's workers will be best poised for these new shifts. She'll also share the organization's outlook for the year and what to expect as new changes for trade and geopolitical tensions take shape.

Recorded at the Annual Meeting in Davos Switzerland 2026

Alojado por:

Más episodios:

La Agenda Semanal

Una actualización semanal de los temas más importantes de la agenda global

Más sobre Inteligencia artificialVer todo

Jessica Apotheker

11 de febrero de 2026