Understanding Value in Media: Perspectives from Consumers and Industry

Rising value, shifting habits and the arrival of “supercompetitors”: How new business models and entrants, and changing consumption preferences are affecting media content production, distribution, access and value.

The disruption of the media industry, with the rise of social media, the digitization of content and the increase in mobile consumption has changed traditional funding models beyond recognition.

The role of media historically has been central to the making of society and the construction of identity. At this dark moment for humanity, threatened by COVID-19 with many people physically isolated, this role is vital in the search for information, stories and art to feed the human spirit and ignite the imagination to overcome the challenges ahead.

This report considers how different stakeholders in media – content creators, advertisers, marketing agencies and individual consumers – each value media content. By analysing this dynamic, the industry – and consumers – can make informed decisions about the future.

Content is king

History provides some context. In the UK the development of the liberal media prior to the 1950s was characterized by a paternalistic model. There was a clear hierarchy when it came to the control of information: in his first five years as editor of the BBC’s cultural weekly magazine from 1929-34, R.S. Lambert was not allowed to see his magazine’s circulation figures in case this "distorted" his editorial judgement.

This model eventually gave way to a popular, audience-driven mass media in the 1980s, when the idea of the media as a source of popular pleasure took root.

Today, as more content is distributed via social platforms and the division between content creators and content consumers is blurred, technology companies – or “supercompetitors” – are taking greater responsibility for guaranteeing the quality and integrity of information. Perhaps as a reaction to this and with a bizarre nod to pre-1950s paternalism, there is a rising call for governments and regulators to take a more proactive role in the production and dissemination of news (although not entertainment) to ensure equitable access to information.

COVID-19: the disruption of the century

The massive disruptions witnessed in the first quarter of 2020 have put a spotlight on the findings of this report.

The current coronavirus challenge only emphasizes the indispensable role that media play in society today. With the value of content growing, the industry needs financial models that enable them to fulfil their social functions while still supporting widespread access to critical content. This can’t happen in isolation: it requires dialogue, including with regulators, to find solutions that balance innovation, consumer welfare and corporate responsibility of every stakeholder in the media industry.

— Kirstine Stewart, Head of Shaping the Future of Media, Entertainment and Culture, World Economic Forum

The impact of the novel coronavirus on the media is mixed. The cancellation of flagship global events, such as the Tokyo Olympics, will disrupt programming, advertising, sponsorship deals and promotional events. According to the New York Times, in 1980, when the United States boycotted the Moscow Olympics, broadcaster NBC lost $34 million despite having insurance.

On a more positive note, the increase in consumption due to self-isolation and quarantine has boosted demand for media. After China implemented nationwide isolation measures, average weekly downloads of apps during the first two weeks of February jumped by 40% compared with the average for the whole of 2019, according to the Financial Times. In the same month, weekly game downloads on Apple devices had increased by 80% compared to 2019.

The information gap and the rise of tech giants

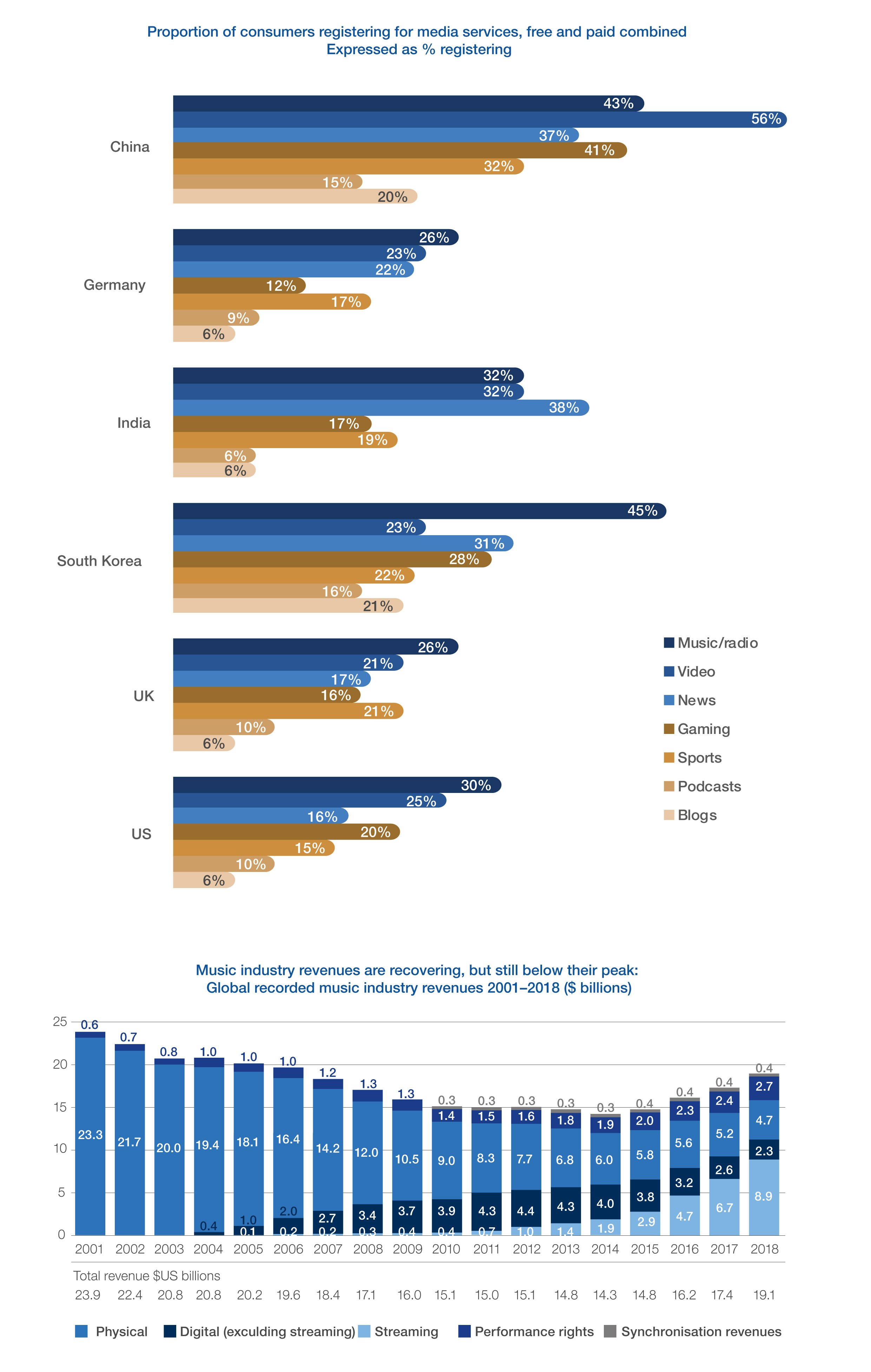

The findings of this report are based on a survey, conducted for the World Economic Forum by Nielsen, which asked over 9,100 people in China, Germany, India, South Korea, the United Kingdom and the United States about their media consumption and payment habits and preferences. In addition, the Forum consulted around 100 executives from advertising, entertainment, news and other parts of the media industry about business strategies to attract and retain consumers – along with the implications these could have for society.

-

96%of the global population reads, watches or listens to news and entertainment

-

23.6 hrsspent viewing media content during a typical week

-

60%consumers of global services are “engaged” (meaning they registered – whether free or paid)

-

16%pay for news

-

44%pay for entertainment

-

61%of young people (16-34) pay for entertainment

-

22%of over 55s pay for entertainment

-

Twicethe number of young people (16-34) in Germany, the UK and the US are likely to pay for news than over 55s

The most apparent trends point to worrying information inequality based on income alongside the rise and rise of the tech supercompetitor:

- Under half of consumers pay for news and entertainment, leading media companies to do everything they can to attract and retain the growing population that is willing to pay. Their strategies are challenged by moves into media by supercompetitors in the digital economy.

- Low-income groups are less likely to pay for news services, suggesting that the rise of paid-for media may lead to information inequalities. Consumers believe governments have a greater responsibility to fund access to news versus entertainment.

- Although the proportion of people paying for content today may be small, future willingness to pay is rising. Globally, the proportion of people willing to pay in the future is 53% for news and 70% for entertainment. Furthermore, two of the most dynamic global economies – China and India – show reasons for optimism.

- In China, 25% pay for news and 59% have at least one paid video or sport service, numbers may be explained by the greater prevalence of pay-per-use models in the country.

- In India, consumers report a willingness to grow the number of news and entertainment services they pay for. Respondents here say they are willing to pay for closer to three entertainment services and four news services, more than the maximum of 1-2 services that most other countries report a willingness to pay for.

Who funds content?

In an industry characterized by disruption, understanding how content creators, consumers and advertisers value media is key. Surveying consumers about their media consumption and payment preferences has been balanced by studying strategies adopted by media businesses and advertisers to improve their value propositions. This report paints a holistic picture of the media landscape – not just in terms of financial sustainability, but also in assessing the value of content to society. The information is indispensable to business and political leaders thinking about the ideal role media should play in people's lives.

Current patterns are more dynamic and responsive in reaching desired audiences, but a greater share of budget now goes to the providers of the tools as opposed to the providers of content. But consumers are wary. A survey by Deloitte found that almost half of American consumers are frustrated by the streaming explosion in entertainment and are likely to pay for only one online news subscription.

- On-demand entertainment has proliferated

- News providers have tightened paywalls

- There is a drive to increase revenue from digital products and from consumers directly

- Consumers have more choice than ever before

- There are different revenue models – some consumer-driven, some advertising-supported

- News organizations are embracing new digital formats (like podcasts)

- The global advertising landscape has changed: it is now online, precisely targeted

- There is widespread subscription fatigue – consumers are tired and frustrated by the sheer quantity of content available and the multitude of ways to access it

The revenue systems are a key driver of the balance of media power. The private sector and large advertisers are shaping the media environment, while it appears that the policy-makers are struggling to keep up. Consumer brands like Procter & Gamble and Unilever, for example, are pushing for improvements themselves in viewability and a reduction of fraudulent activity online.

Considering the important question of who should be responsible for funding the production of content, the survey suggests that consumers expect governments to take a bigger role in supporting access to news than entertainment: 35% versus 18% respectively.

As these trends play out in an increasingly dynamic environment, media companies are pursuing strategies to attract and retain paying consumers. This includes the so-called supercompetitors. These companies use content to drive value to other parts of their businesses. In doing so, they create opportunities and challenges for the industry – but the precise impacts are unknown. It’s time to study the potential effects and think about how regulation could be used to balance innovation, consumer welfare and corporate responsibility more effectively.

The real value in media

Today’s coronavirus-related disruption may be unprecedented, but the media industry has been upended many times before. What has stayed constant throughout is the indispensable role that media play in society. Media don’t just help pass the time; they keep people informed. Increasingly, media create shared cultural moments and capture identity. We need a more dynamic measure to calculate the real value of media to society.

Access to or quality of content is better than ever. But while destination media compete to become leaders in their specific areas, the tech giants are working out how to use media to monopolize time, spend and data. What will be the impact of the strategies of the tech giants on the overall media landscape?

The poet and novelist, Ben Okri, writes, “It may well be that it is not only self-isolation and science that saves us. We may also be saved by laughter, by catharsis, by the optimism of being able to see beyond these times, with stories, with community, with songs.”

In the absence of real contact, interaction and the consumption of experience is now mostly mediated. The value and integrity of media has never been more relevant.