Global Risks Report 2026

The Global Risks Report 2026, the 21st edition of this annual report, marks the second half of a turbulent decade. The report analyses global risks through three timeframes to support decision-makers in balancing current crises and longer-term priorities. Chapter 1 presents the findings of this year’s Global Risks Perception Survey (GRPS), which captures insights from over 1,300 experts worldwide. It explores risks in the current or immediate term (in 2026), the short-to-medium term (to 2028) and in the long term (to 2036). Chapter 2 explores the range of implications of these risks and their interconnections, through six in-depth analyses of selected themes. Below are the key findings of the report, in which we compare the risk outlooks across the three-time horizons.

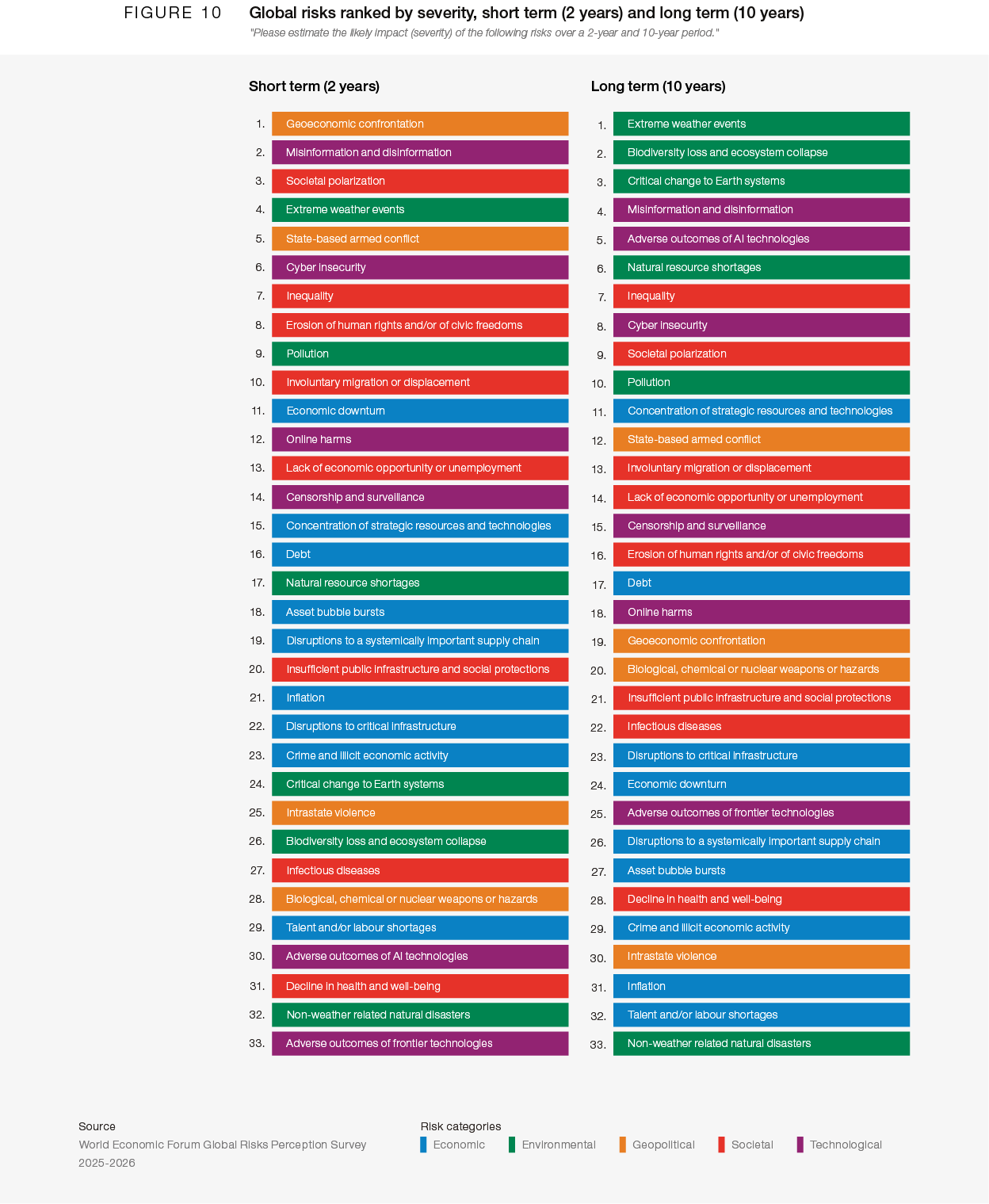

Uncertainty is the defining theme of the global risks outlook in 2026. GRPS respondents viewed both the short- and long-term global outlook negatively, with 50% of respondents anticipating either a turbulent or stormy outlook over the next two years, deteriorating to 57% of respondents over the next 10 years (Figure 1).

A further 40% and 32%, respectively, view the global outlook as unsettled over the two- and 10-year time frames, with only 1% anticipating a calm outlook across each time horizon.

As global risks continue to spiral in scale, interconnectivity and velocity, 2026 marks an age of competition. As cooperative mechanisms crumble, with governments retreating from multilateral frameworks, stability is under siege. A contested multipolar landscape is emerging where confrontation is replacing collaboration, and trust – the currency of cooperation – is losing its value.

This year’s GRPS findings show heightened short-term concerns compared to last year, with a 14 percentage-point increase in respondents selecting a turbulent or stormy outlook over the next two years. By contrast, compared with last year, there is a five percentage-point improvement over the next 10 years in those two categories (from 62% last year to 57% this year), with a slight uptick in respondents selecting either a calm or stable outlook (up three percentage points) or an unsettled outlook (up two percentage points).

Multilateralism is in retreat

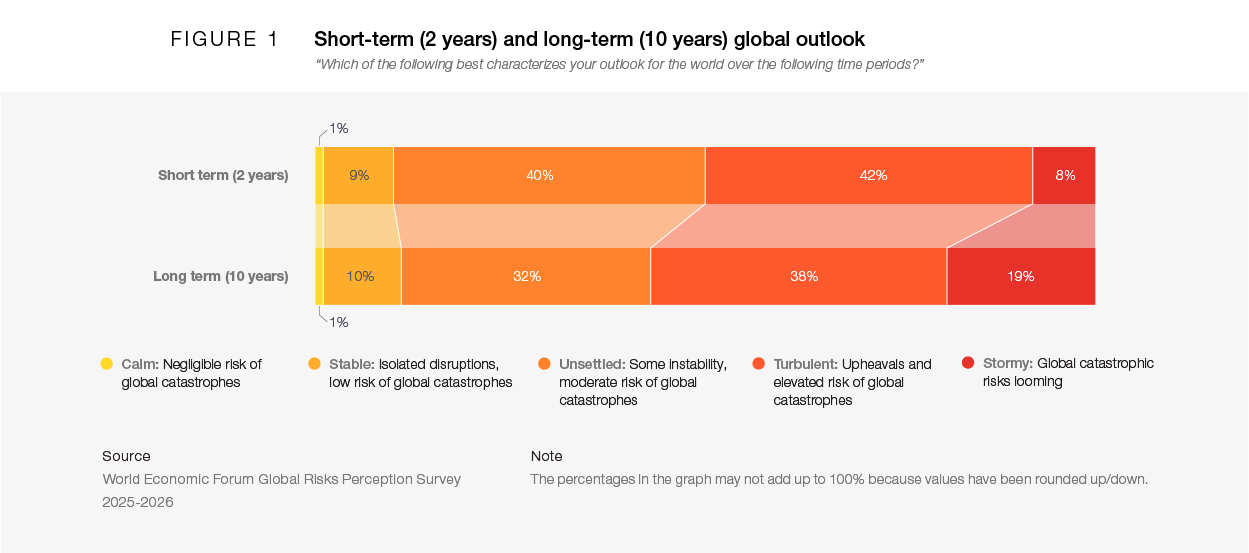

The multilateral system is under pressure. Declining trust, diminishing transparency and respect for the rule of law, along with heightened protectionism, are threatening longstanding international relations, trade and investment and increasing the propensity for conflict. Geoeconomic confrontation is top of mind for respondents and was selected as the top risk most likely to trigger a material global crisis in 2026 by 18% of respondents, increasing two positions from last year (Figure 2).

This is followed by State-based armed conflict, selected by a further 14% of respondents.

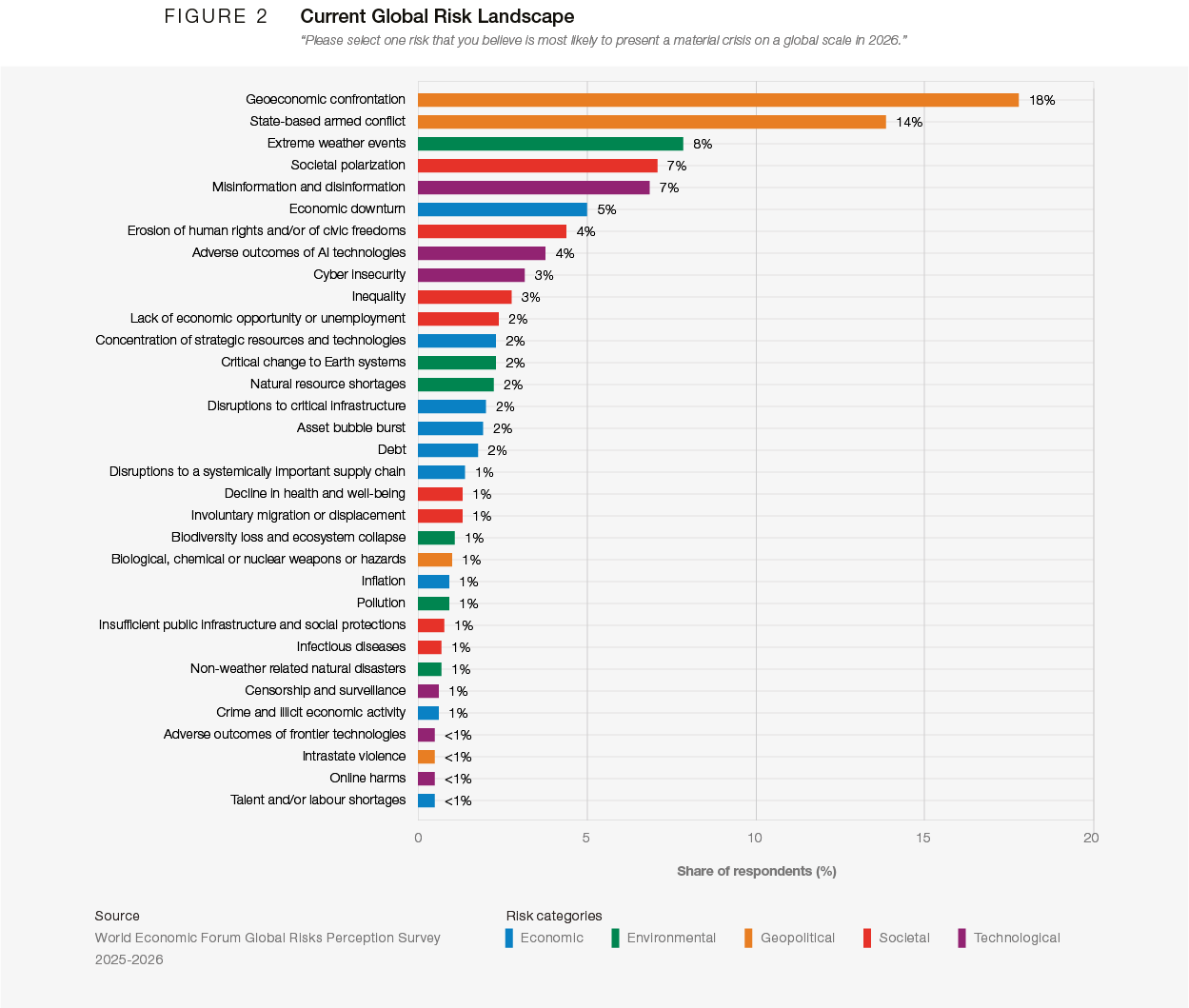

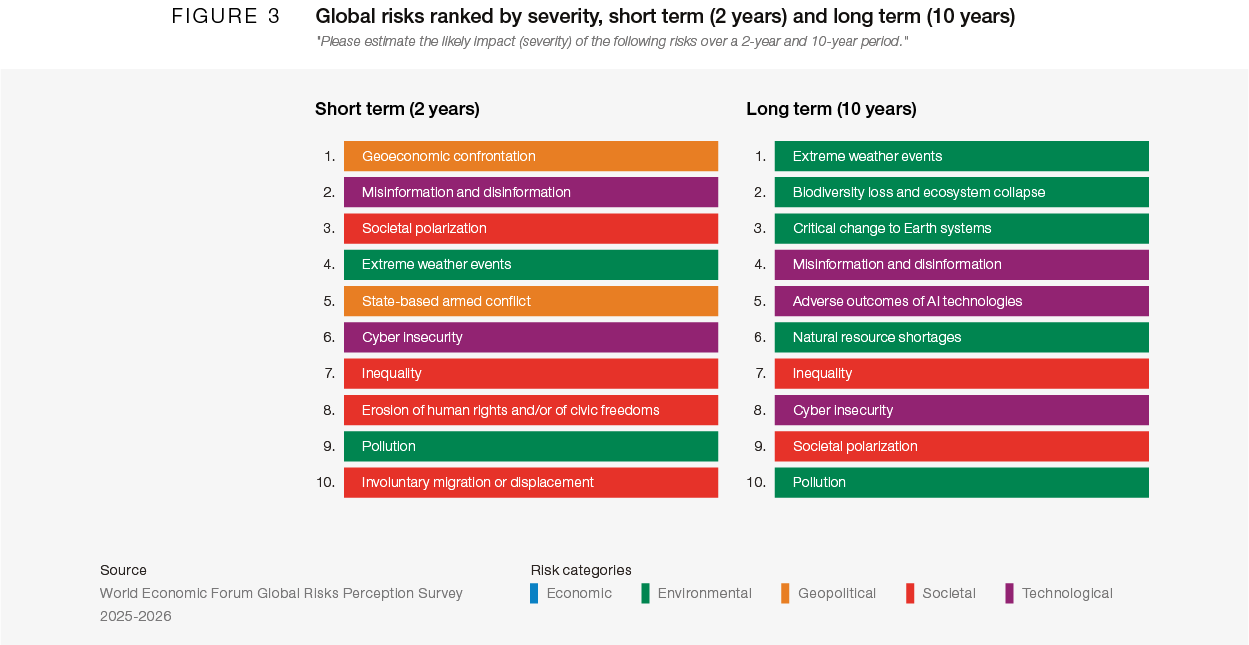

In a world already weakened by rising rivalries, unstable supply chains and prolonged conflicts at risk of regional spillover, such confrontation carries systemic, deliberate and far-reaching global consequences, increasing state fragility. The centrality of Geoeconomic confrontation in the global risks landscape is not restricted to 2026, with respondents selecting it as the top risk over the two-year time horizon (to 2028, Figure 3), as well, up eight positions from last year (Figure D).

Geoeconomic confrontation threatens the core of the interconnected global economy, as explored further in Section 2.2: Multipolarity without multilateralism.

Economic risks are intensifying

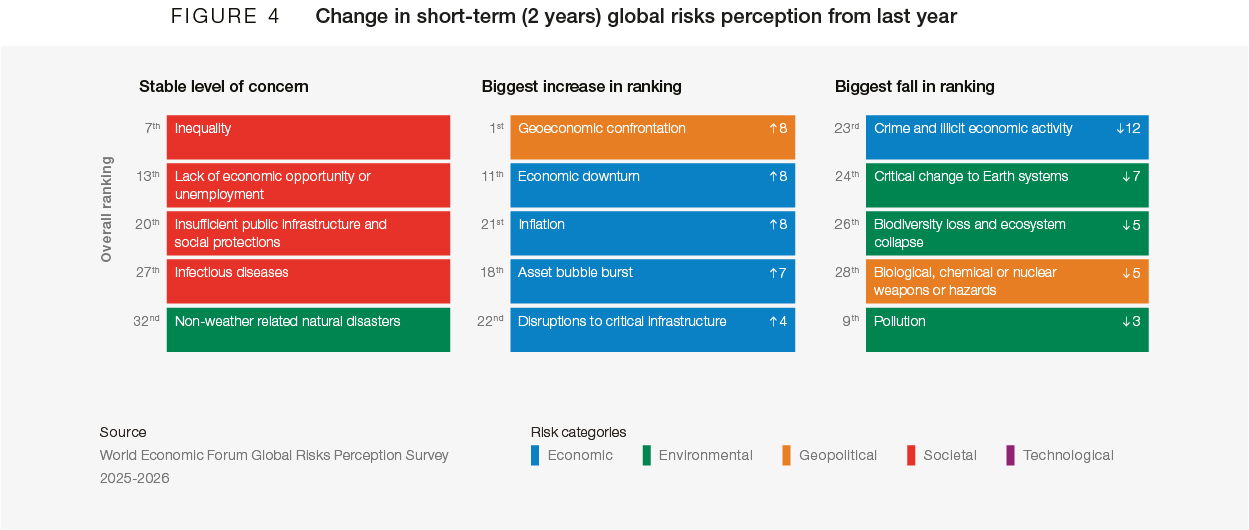

Economic risks, taken collectively, show the largest increases in ranking over the next two years, albeit from relatively low rankings last year. Economic downturn and Inflation are both up eight positions, to #11 and #21 respectively, with a similar uptick for Asset bubble burst, up seven positions to #18 (Figure 4).

Economic downturn has witnessed one of the largest increases in severity score compared with last year’s findings, behind only Geoeconomic confrontation. Section 2.4: An economic reckoning explores how, over the next two years, mounting debt sustainability concerns coupled with potential economic bubbles – in a context of rising Geoeconomic confrontation – could herald a new phase of volatility, potentially further destabilizing societies and businesses.

Technological risks are growing, largely unchecked

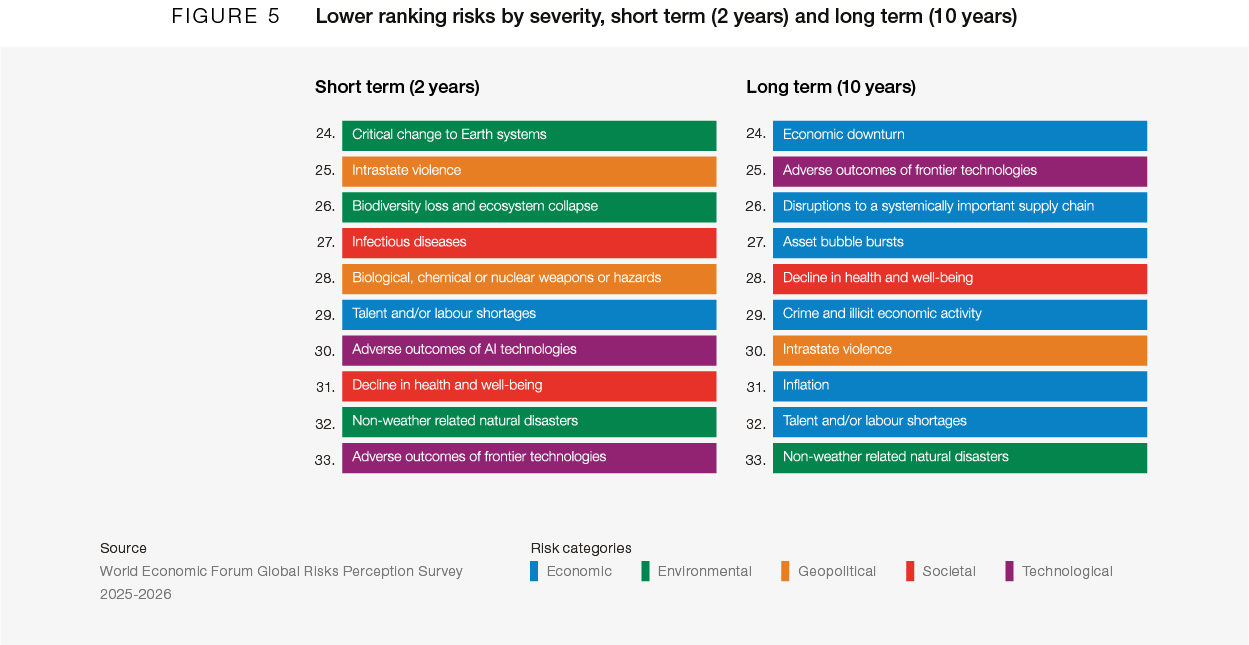

Technological developments and new innovations are driving opportunities, with vast potential benefits from health and education to agriculture and infrastructure, but also leading to new risks across domains, from labour markets to information integrity to autonomous weapons systems. Misinformation and disinformation and Cyber insecurity ranked #2 and #6, respectively, on the two-year outlook. Adverse outcomes of AI is the risk with the largest rise in ranking over time, moving from #30 on the two-year outlook to #5 on the 10-year outlook. Section 2.7: AI at large explores how, over the next decade, AI could impact labour markets, societies and global security. Conversely, Adverse outcomes of frontier technologies, which moves from #33 in the two-year ranking to #25 in the 10-year ranking (Figure 5), remains relatively low overall. Section 2.6: Quantum leaps explores how an acceleration in quantum technologies can offer significant opportunities to societies and economies, from improving the accuracy and speed of climate and weather modelling to the discovery of new drugs.

Yet, advancements in the quantum field also risk becoming another facet of strategic rivalry, economic bifurcation and political polarization.

Societies are on the edge

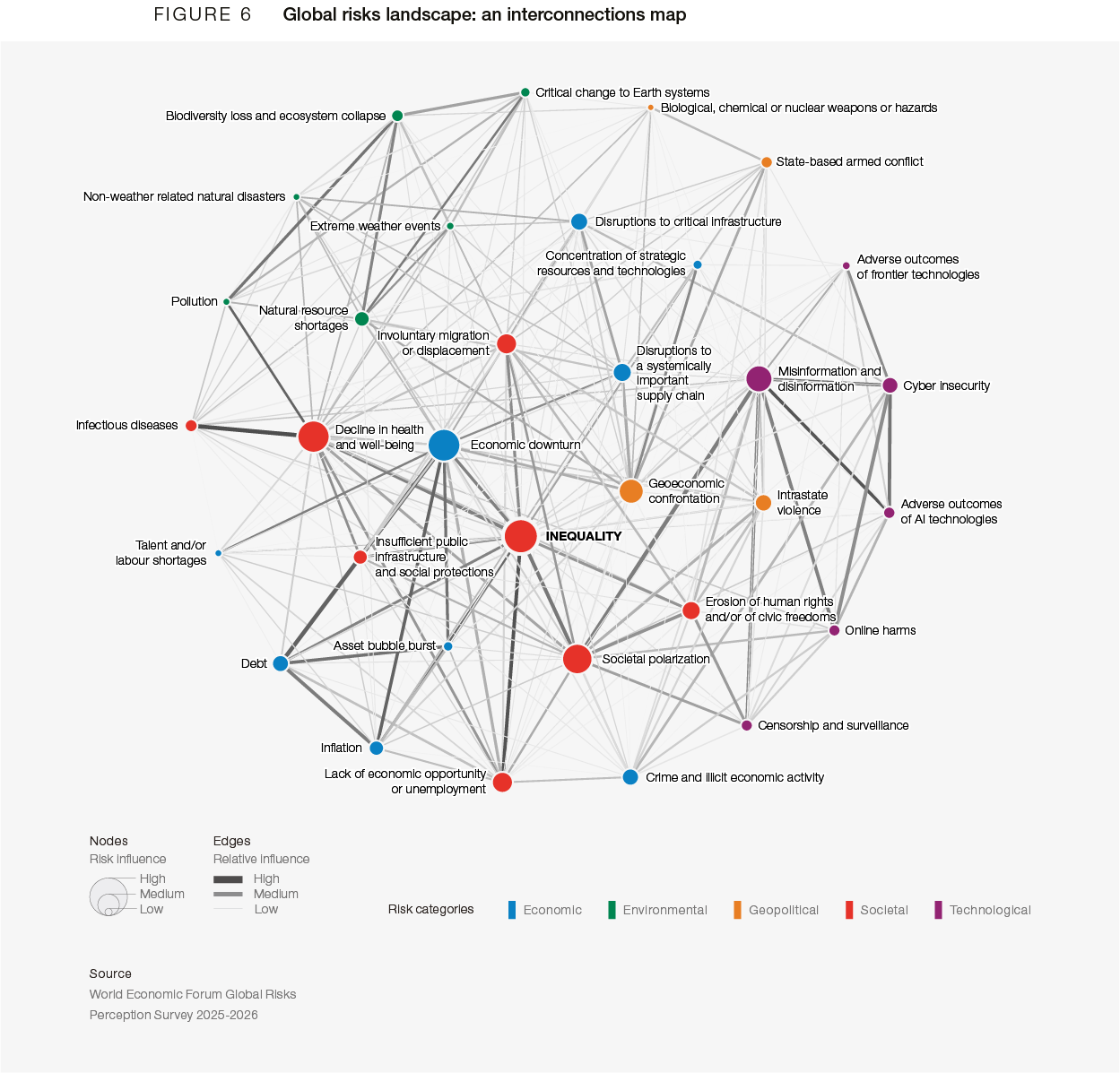

Rising societal and political polarization is intensifying pressures on democratic systems, as extremist social, cultural and political movements challenge institutional resilience and public trust. The growing prevalence of “streets versus elites” narratives reflect deepening disillusionment with traditional governance structures, leaving many citizens feeling excluded from political decision-making processes and increasingly skeptical that policy-making can deliver tangible improvements to livelihoods. Inequality was selected by respondents as the most interconnected global risk for a second year running, followed closely by Economic downturn (Figure 6).

In parallel, Misinformation and disinformation in second position in the two-year timeframe, below Geoeconomic confrontation, remains an acute global concern. As wealth continues to concentrate in the hands of a few, while cost of living pressures remain high, permanently K-shaped economies are becoming a risk, calling the social contract and its financing into question. Section 2.3: Values at war explores how societal and political polarization may deepen over the next two years as technology becomes more embedded in daily life and geoeconomic tensions persist, heightening the risks of increased digital distrust and dilution of socio-environmental progress.

Environmental concerns are being deprioritized in the short term

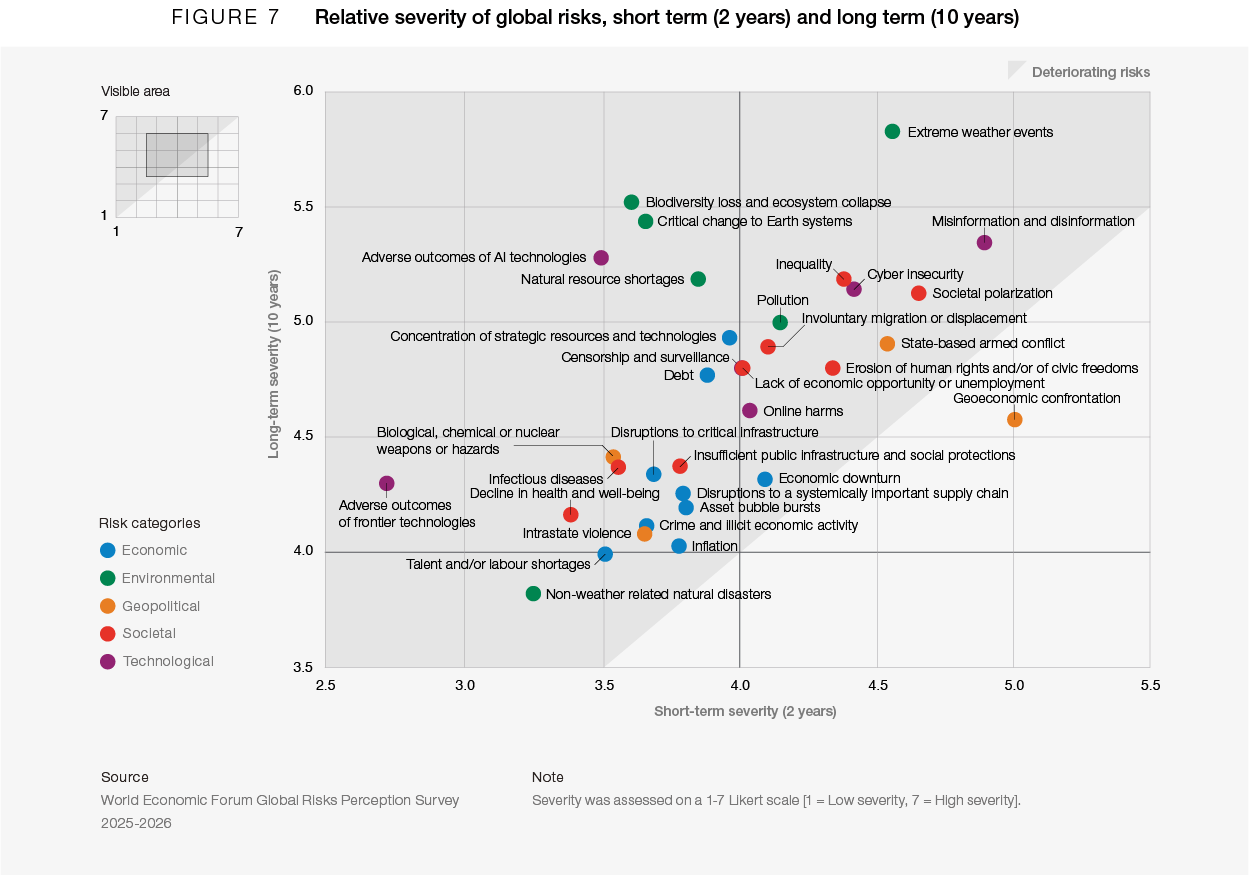

The GRPS findings suggest heightened prioritization of non-environmental risks relative to environmental ones compared to previous years. In the outlook for the next two years, a majority of environmental risks experienced declines in ranking, with Extreme weather events moving from #2 to #4 and Pollution from #6 to #9. Critical change to earth systems and Biodiversity loss and ecosystem collapse also declined, by seven and five positions, respectively, and are in the lower half of the risk list this year in the two-year outlook. All environmental risks also declined in severity score for the two-year time horizon compared with last year’s findings. In other words, not only do their rankings decline relative to other risk categories, but there has also been an absolute shift away from concerns about the environment. In the next 10 years, environmental risks have retained their ranking as the most severe risks, with Extreme weather events identified as the top risk and half of the top 10 risks being environmental in nature (Figures 7 and 10).

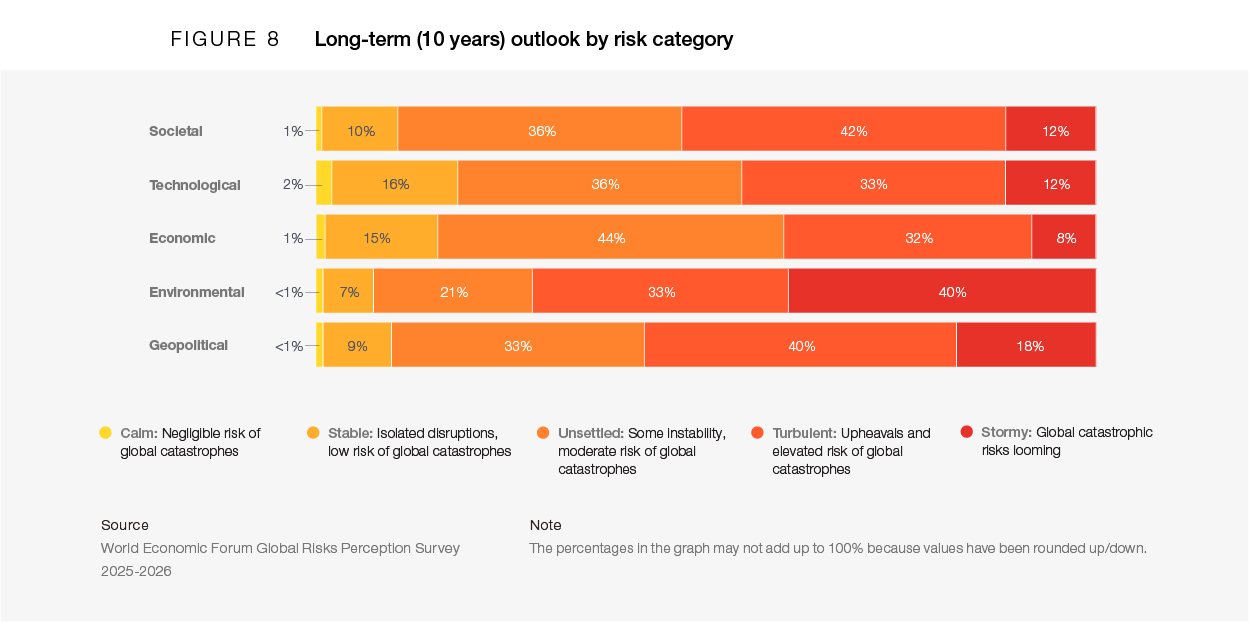

In this year’s GRPS, we also asked respondents about their perceptions of the global outlook by risk category: societal, technological, environmental, economic and geopolitical. Over the next decade, environmental risks were perceived with the most pessimism out of all risk categories surveyed, with close to three-quarters of respondents selecting either a turbulent or stormy outlook (Figure 8).

Chapter 2.5: Infrastructure endangered explores, in part, the effects of continued extreme weather and climate change on ageing infrastructure. From supply-chain chokepoints to strains on electrical grids, critical infrastructure requires renewed attention, with the current risks already playing out and affecting societies globally.

A new competitive order is emerging

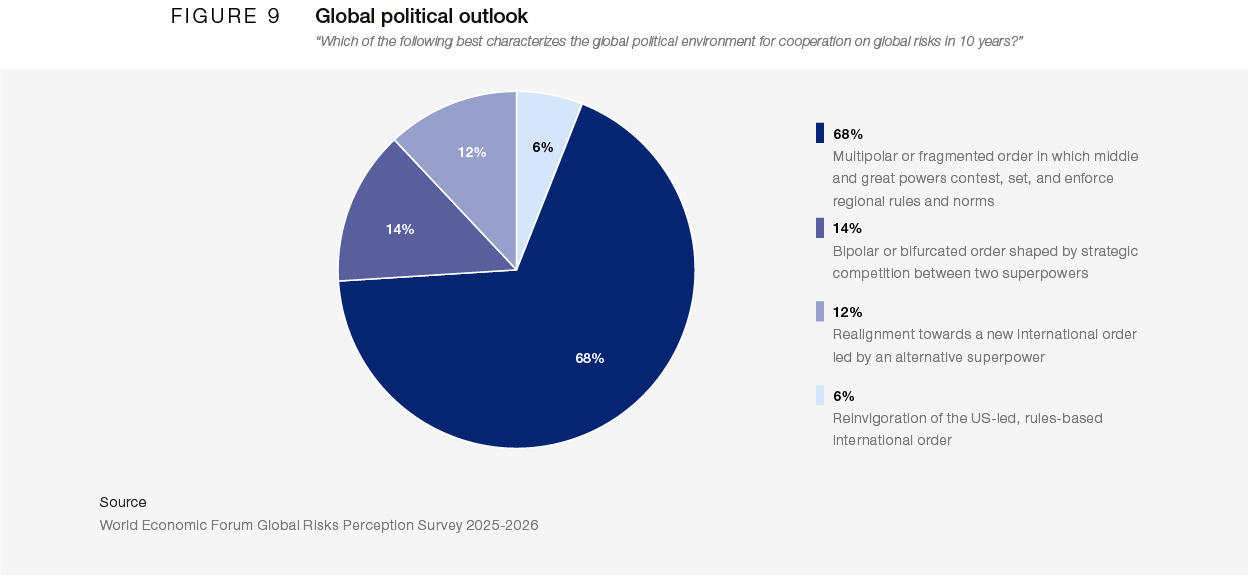

In this period of geoeconomic transformation, alliances are being reshaped and the resilience of markets and of the institutions that emerged from the Bretton Woods Conference of 1944 is being tested. Protectionism, strategic industrial policy and active influence by governments over critical supply chains all signal a world growing more intensely competitive. In this year’s GRPS, 68% of respondents describe the global political environment over the next 10 years as a “multipolar or fragmented order in which middle and great powers contest, set and enforce regional rules and norms”, an increase of four percentage points compared to last year (Figure 9).

Only 6% of respondents expect a reinvigoration of the previous unipolar, rules-based international order.

The growing shift toward more inward-looking and adversarial policies has cast further uncertainty over the future of multilateralism. As nations increasingly prioritize national interests over collective action, pressing questions emerge about the capacity of the international community to confront shared challenges such as climate change, global health and economic stability – as well as generate the local growth needed for domestic prosperity and stability. In this evolving landscape, global leadership and the values that will underpin the next phase of international cooperation are issues that remain critically unresolved.

Yet, history reminds us that order can be rebuilt if nations choose strategic collaboration even amid competition. The future is not a single, fixed path but a range of possible trajectories, each dependent on the decisions we make today as a global community. The challenges highlighted in the GRPS – spanning geopolitical shocks, rapid technological change, climate instability, economic uncertainty and their collective impact on societies – underscore both the scale of the risks we face and our shared responsibility to shape what comes next.